Cards In This Set

| Front | Back |

|

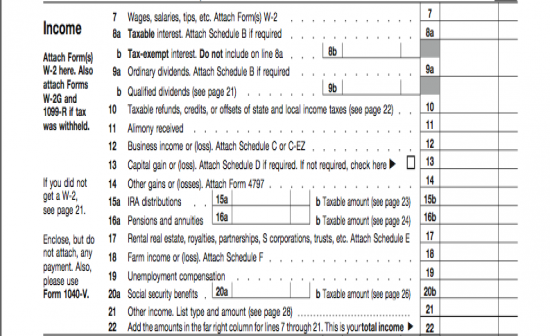

FORM 1040 Line 7

|

Wages, salaries, tips, etc. Attach Form(s) W-2 |

|

FORM 1040 Line 8a

|

Taxable interest. Attach Schedule b if requiredSchedule B reports the interest and dividend income you receive during the tax year. However, you don’t need to attach a Schedule B every year you earn interest or dividends. It is only required when the total exceeds certain thresholds. In 2012 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

|

|

FORM 1040 Line 8b

|

Tax Exempt interest. Do not include on line 8a

|

|

FORM 1040 Line 9a

|

Ordinary Dividends. Attach Schedule B if required

|

|

FORM 1040 Line 9b

|

Qualified Dividends

|

|

FORM 1040 Line 10

|

Taxable refunds, credis, or offsets of stat eand local income taxes

|

|

FORM 1040 Line 11

|

Alimony Received

|

|

FORM 1040 Line 12

|

Business income or (loss). attach Schedule C or C-EZ

|